- Sep 20

- 32 min read

Ultimate guide to market research for startups

Researching the market may seem straightforward, but it involves much more than searching on Google. Identifying current trends in your industry as they relate to competitors and the consumer climate is crucial to conducting successful market research. Who is making waves in the industry? How can you measure up and get ahead? Who are your customers? Etc.

Every human has timeless truths, like what they like and dislike, what they value, and what they need. Our mechanisms for targeting audiences have become increasingly sophisticated; thus, brands and institutions need to discover more about these audiences to serve them better.

The decisions businesses face today revolve around target markets, pricing, promotions, distribution channels, and product features and benefits. Research studies and methodologies have been developed to capture meaningful data to inform each decision that must consider various factors.

Table of contents |

What is market research?

According to the American Marketing Association, marketing research is the systematic gathering, recording and analysing of data about marketing goods and services problems. Market research aims to gather data about your customers so your team can verify whether or not a new product is successful or improve an existing product. It also helps you understand the perception of your brand, allowing your team to effectively communicate your business's value.

Every small business owner should ask the following questions to devise effective marketing strategies:

- Who are my customers and potential customers?

- What kind of people are they?

- Where do they live?

- Can and will they buy?

- Am I offering the goods or services they want—at the right channel, at the best time and in the right amounts?

- Are my prices consistent with what buyers view as the product’s value?

- Are my promotional programmes working?

- What do customers think of my business?

- How does my business compare with my competitors?

Although market research is capable of answering various questions about an industry, it is not a crystal ball marketers can use for insights into their customers. Market researchers investigate several market areas to depict the business landscape accurately. In addition to these strategies, market research offers additional benefits. You can make good judgment calls based on your experiences in the industry and the customers you already have.

Learn more about the difference between Market Research and Consumer Insights here.

Why does your startup need market research?

By conducting market research, you can meet your buyer where they are. This is essential in an increasingly noisy world (both digital and analog). Your product or service will naturally appeal to buyers when you understand their problems, pain points, and desired solutions.

In addition to providing insight into your bottom line, market research can also provide insight into:

- Where to approach your target audiences

- Which of your competitors does your target audience look to for information, options, or purchases

- What are the current trends in the market

- What are the potential factors that influence purchases

- How consumers react to certain topics

- How is the demand within a specific market

- What are the unaddressed needs of customers

- What are the customers’ attitudes about the current pricing

You will gain a deeper understanding of consumer attitudes through market research because it provides information from a larger sample size of your target audience. By knowing the bigger picture, you can make better business decisions.

Types of market research

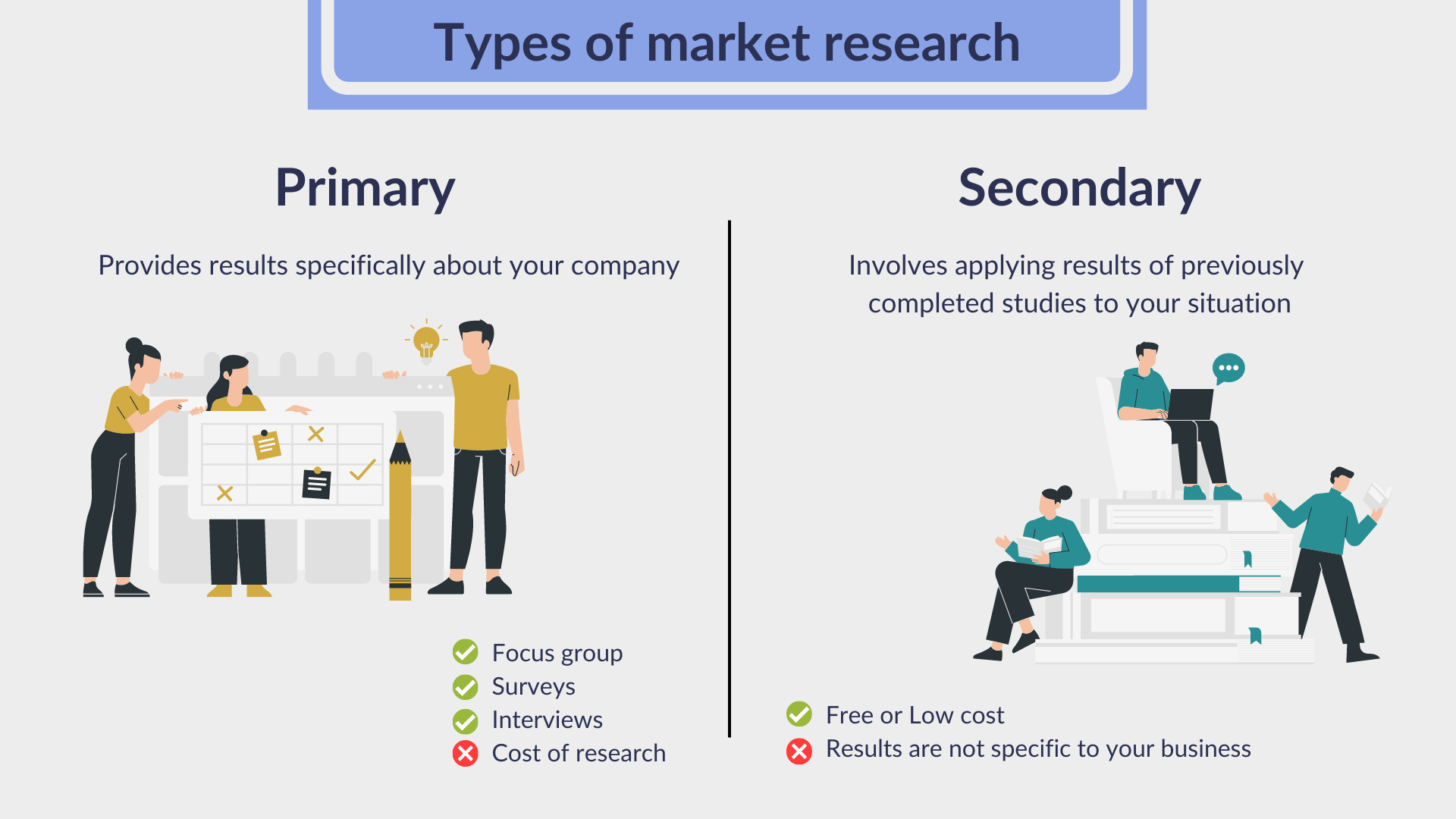

There are two types of market research methods: primary and secondary research. There are distinct differences between these methods and how to apply them.

Primary research

You can conduct primary research using various methods, such as surveys, focus groups, data analysis, observation, interviews, etc.

As technology has progressed, brands now have access to simple, easy-to-use tools, such as Qualtrics and Typeform, that help them handle vast volumes of data, which was once a daunting concept. Therefore, brands have greater confidence in their data and can see the insights in real-time.

Primary research is fundamentally tailored toward gathering context-specific data that can solve a particular problem. In addition, it allows the researcher to gather first-hand information that can be considered more valid and authentic in a research environment.

This research approach gives the researcher full control over the data because they own it. For example, a brand wanting to obtain customer satisfaction feedback will employ primary research methods to gather relevant data to inform practical product improvement decisions.

Secondary research

In secondary research, data is collected, analysed, and often used to support primary research.

There are several advantages for small businesses to conduct this type of research, including obtaining it often through research companies (although primary research tools are challenging this) and a cheaper alternative for businesses on a budget.

Secondary research is much more cost-effective than primary research, as it uses existing data.

Secondary and primary research have advantages, but they work best together to give you the confidence to act on your hypothesis.

Different types of primary research

Several data collection methods are available if you decide to conduct primary research. For example:

- Surveys

- Focus groups

- Customer Observation

- Interviews

Before choosing a data collection method, think carefully about what you’re trying to achieve. A simple multiple-choice survey will generate different information than an in-depth interview. Each has its pros and cons. Decide whether your primary research is exploratory or specific and whether you’ll need qualitative or quantitative data.

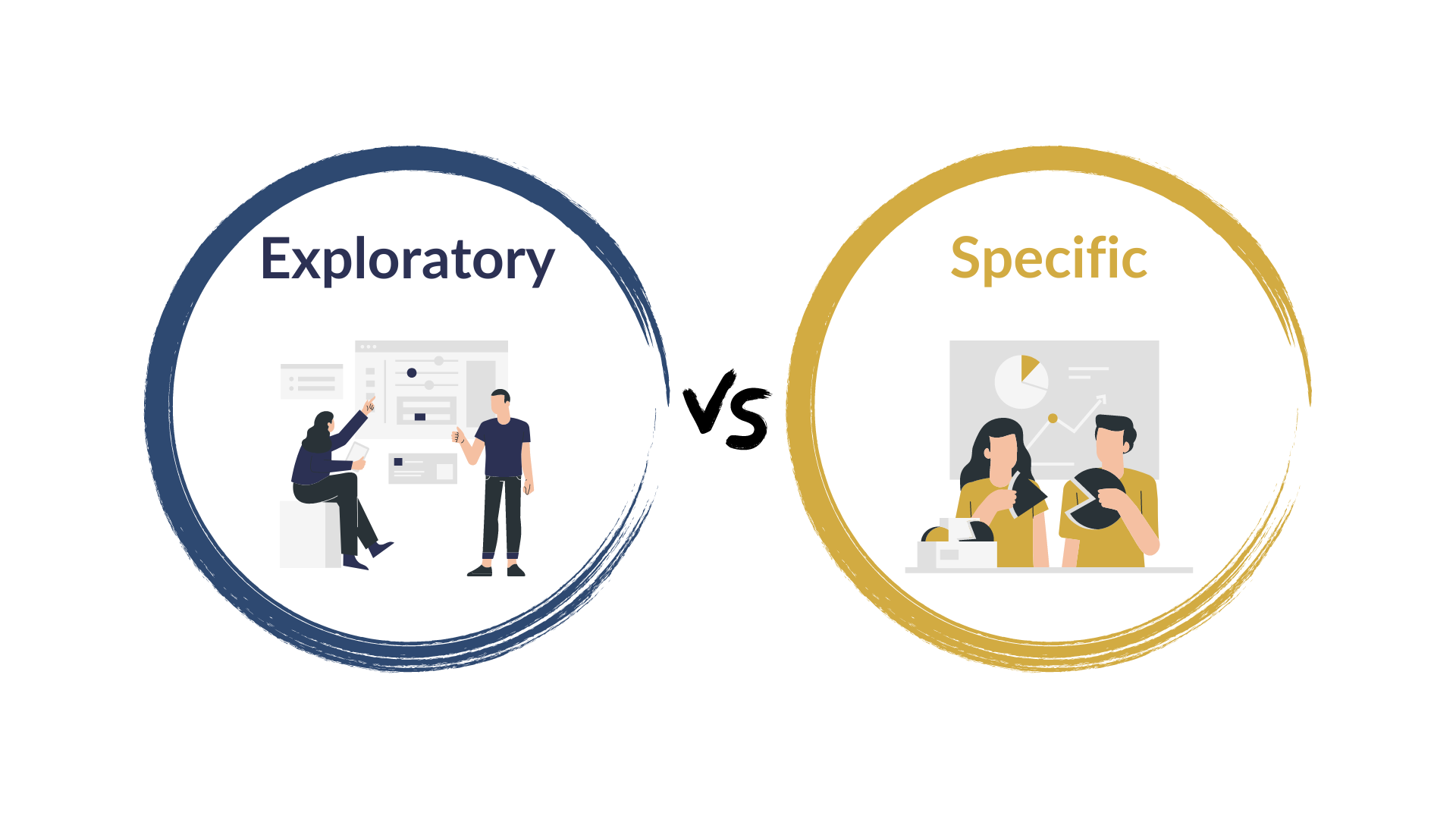

Exploratory vs specific

Primary research focuses on gathering first-hand information about your industry and your customers. Segmentation is helpful when segmenting your market and creating your buyer persona. Primary market research tends to fall into two buckets: exploratory and specific.

Exploratory. Primary market research focuses less on measurable customer trends and more on possible problems that would be worth addressing as a team. An open-ended interview or survey may be conducted with small numbers of people as a first step before any specific research is completed.

The following are some examples of studies with exploratory research design in business studies:- A study into the role of social networking sites as an effective marketing communication channel

- An investigation into how to improve the quality of customer services within the hospitality sector in London

- An assessment of the role of corporate social responsibility on consumer behaviour in the pharmaceutical industry in the UK

Specific. The purpose of specific primary market research is to dig into issues or opportunities the business has identified as necessary following exploratory research. Companies can conduct market research by focusing on a smaller or more specific audience segment and asking questions to solve suspected problems.

The following are some examples of studies with exploratory research design in business studies:

- A study into how fintech news would increase audience interaction on social media.

- A survey into how a free trial extension would increase a customer's likeability to purchase a SaaS company's service.

In short, exploratory research is typically conducted through qualitative data collection, while specific research is usually conducted through quantitative data collection.

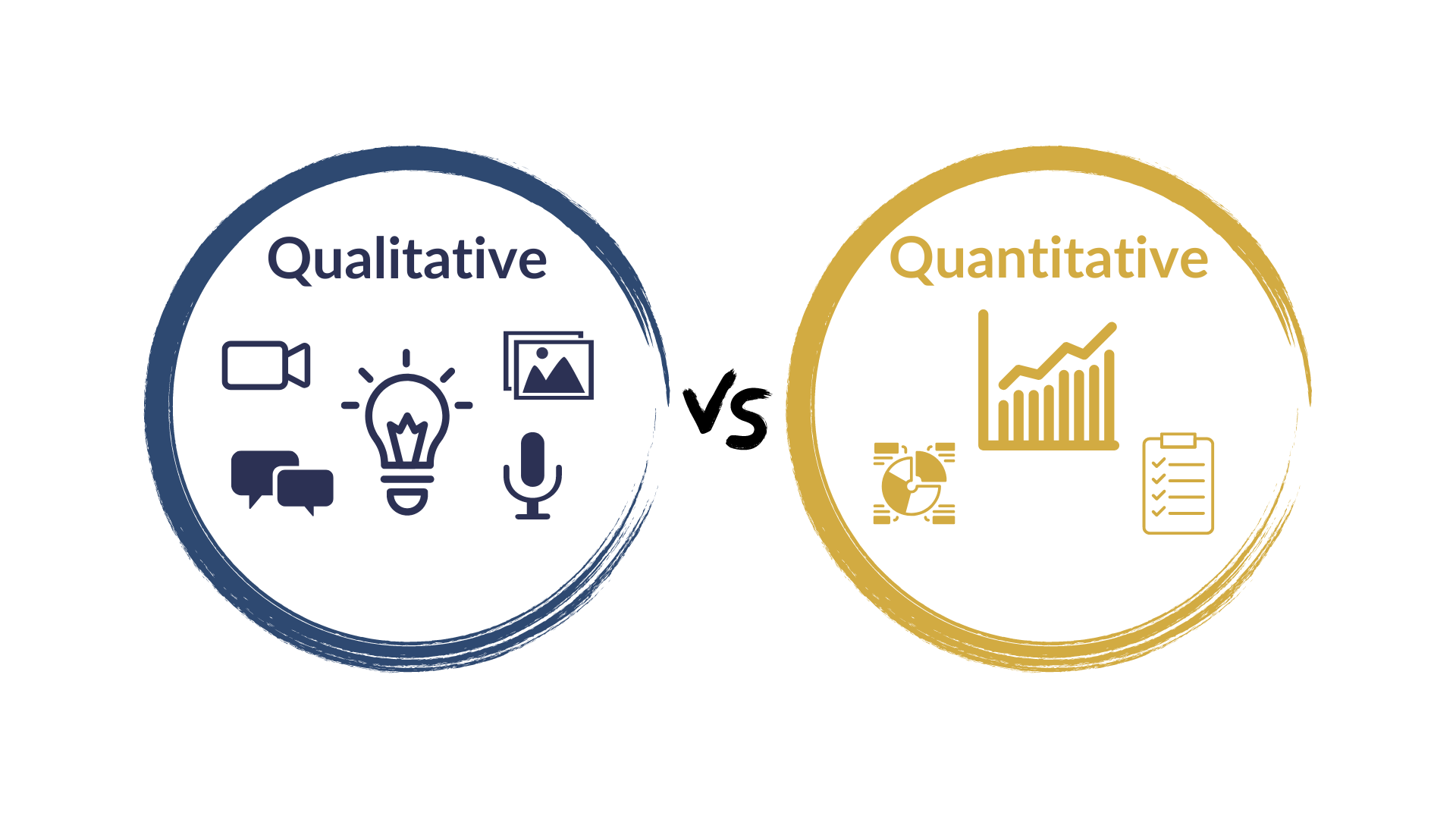

Qualitative vs quantitative

Qualitative research aims to collect non-numerical data, summarise and infer rather than pinpoint truths, and generate a hypothesis. Research methods that would gather qualitative data include:

- One-to-one interview – This is a conversational method that allows opportunities for in-depth interaction with each respondent and enables the researcher to get detailed opinions from all respondents.

- Focus groups - A focus group usually includes a limited number of respondents (6-10) from within your target market.

- Ethnographic research – Researchers immerse themselves in groups or organisations to understand their cultures.

- Case study research - A case study is a detailed study of a specific subject, such as a person, group, place, event, organisation, or phenomenon. Case studies are commonly used in social, educational, clinical, and business research. Case studies provide insight into real challenges and an in-depth look at how your company goes about solving them. They allow you to display your strategic thinking and approach, expertise and innovation, and ability to follow through on your promised solution.

- Record keeping - New research can be conducted using this data. You can collect relevant data by reading books and referring to other reference materials. It's the same as going to the library.

Rather than identifying the exact truth held by a target market, this kind of market research is used to summarise and infer. Qualitative market research can, for instance, help a company understand how a new target market will receive a new product.

An example of qualitative research can be as follows:

- To understand more about the customer, a SaaS company decides to take a one-to-one interview approach with a few people of their target customers. With several questions, the company will be able to:

- Assess customer demand.

- Highlight customer pain points

- Understand customer needs

- Get inspiration for product development

- Empathise with your customers

- Develop trust with their customers & potentially identify a new target audience

It is common for quantitative researchers to start with a hypothesis and then collect data to determine if that hypothesis is supported by empirical evidence. On the other hand, data collected in quantitative research is numerical, and it is much more black and white compared to qualitative research data. Quantitative research methods include:

- Experiment - Control or manipulate an independent variable to measure its effect on a dependent variable

- Questionnaires

- Surveys - Ask questions of a group of people in-person, over-the-phone or online

- Systematic observation - Identify a behaviour or occurrence of interest and monitor it in its natural setting

- Secondary research - Collect data for other purposes, e.g., national surveys or historical records.

An example of quantitative research can be as follows:

An example of quantitative research can be as follows:

- A Fintech company wants to optimise their website to increase its overall conversion rate. Some different factors and elements could influence a customer's decision to make a purchase. The marketer would like to test whether different versions of the “call-to-action" buttons on the homepage would have different conversion rates.

-

- 2 different versions of the “call-to-actions" will be implemented on the home page for the same period.

- Afterwards, the marketer will analyse the result and move forward with the version that has a higher conversion rate.

How to conduct primary research?

Primary research includes surveys, focus groups, observation, and interviews.

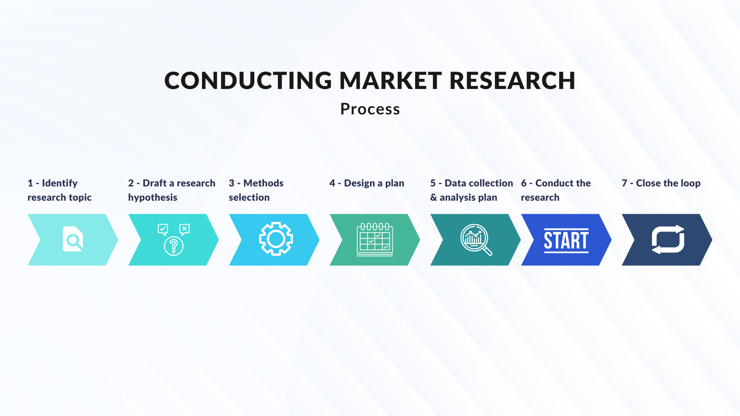

Step 1: Identify your research topic

A brand’s ability to control specific research topics may vary according to size and team structure. For example, a marketing team in a startup may be responsible for overseeing everything, while a larger organisation may split up topics among teams of varying sizes. These research areas could be:

- Product features

- Product launch

- Understanding a new target audience

- Brand identity

- Marketing campaign concepts

- Customer experience

Step 2. Draft a research hypothesis

A product’s purchase potential can be determined by understanding your audience’s motivations, how they feel about a new feature, or how much they’ll spend. Using the data, what do you hope to learn about your consumers? How will the responses help you meet your business goals?

Step 3: Determine which research methods you will use

Choosing a research approach may depend on your budget and how quickly you need to complete the study. For example, you may want to start with focus groups, surveys and interviews to get a mix of qualitative and quantitative data.

Step 4: Organise your study by designing a plan

Here are some questions you’ll need to answer:

- What is the timeframe?

- What is your required sample size?

- Who is your target audience for this research?

It can be difficult for people who have never undertaken primary research to know where to begin. In this step of the market research process, it’s time to design your research tool. If a survey is the most appropriate tool, you’ll begin by writing your questions and creating your questionnaire. If a focus group is your instrument, you’ll start preparing questions and materials for the moderator. This is the part of the process where you start executing your plan.

Additionally, you should test your survey instrument with a small group before broad deployment. This will allow you to catch potential problems early, and there are always problems. Take your sample data, get it into a spreadsheet, and identify any issues with the data structure.

Step 5: Prepare a data collection and analysis plan

Primary research aims to uncover actionable insights, but identifying where to begin or what to focus on can be difficult.

Brands are taking their market research and data analysis in-house because technology simplifies the process. Many tools help you sift through large amounts of data and highlight important information you need to know, for example, Qualtric or Typeform.

Step 6: Conduct your research

This is the meat and potatoes of your project; the time when you are administering your survey, running your focus groups, conducting your interviews, implementing your field test, etc. The answers, choices, and observations are collected and recorded, usually in spreadsheet form. Each nugget of information is precious and will be part of the masterful conclusions you will soon draw.

Once that’s all done, the fun begins. Run summaries with the tools provided in your software package (typically Excel, SPSS, Minitab, etc.), build tables and graphs, segment your results by groups that make sense (i.e. age, gender, etc.), and look for the major trends in your data. Start to formulate the story you will tell.

Step 7: Close the loop

There’s still work to be done. What does the data suggest? What insights can you gain and how will they impact your decision-making or behaviour?

How will you proceed from here?

To ensure you are closing the loop and maximising the impact of the data on your business, share the insights within your team and assign actions. Secondary research may be needed to supplement your primary research.

You’ve spent hours pouring through your raw data, building useful summary tables, charts and graphs. Now is the time to compile the most meaningful takeaways into a digestible report or presentation. A great way to present the data is to start with the research objectives and business problems identified in step 1. Based on the data, restate those business questions, and then give your recommendations to address those issues.

Secondary research - where to find and how to apply it

You can carry out secondary research from a variety of sources. Some of the information is free, while other data can cost your company a lot of money. There are three broad categories of secondary research sources:

- Public sources: Many secondary research sources, such as census data and library catalogues, are public. They are accessible to anyone who asks for them. It is not uncommon for other organisations to give away free data to advance a cause or attract attention.

- Internal sources: Often, your organisation's most valuable data sources already exist. Internal sources for secondary research may be preferable because they are affordable (free) and unique. It is possible to gain a distinct competitive advantage using internal sources since competitors cannot access them.

- Commercial sources: An excellent way to acquire secondary market research is simply buying it. Many companies specialise in market research and can provide reliable, in-depth, industry-specific reports.

How do you know if a source is reliable?

To draw accurate conclusions, you must ensure that the source from which you are doing your research is reputable and reliable. Consider XM Institute, Forrester, Gartner, Mckinsey, or government websites that publish free research by established and respected researchers. It minimises the data's risk of misinterpretation by taking the information directly from the source (rather than a third party).

How to apply secondary research?

Depending on your circumstances, you can use secondary research for several different purposes and applications. In an ideal situation, secondary research may support primary research and increase your confidence in your findings. Nevertheless, some factors, such as project budgets and schedules, may prevent this.

Often, secondary research is preferred because people underestimate the feasibility of primary research, which is slow and expensive and only shows a snapshot of a moment in time.

When collecting all the relevant secondary research, ensure there aren't any biases in the collection process, then begin analysing the conclusions to see if any patterns emerge. This will enable you to draw an overall conclusion from the secondary research.

Communicating your market research findings

Make sure your market research is not ignored or discarded by following these six simple steps:

- Less is more: You should begin your report with an executive summary highlighting the fundamental discoveries you made and their implications.

- Answer the question: Present the top 4-5 recommendations in bullet points rather than pages of analysis and data

- Model the impact: Based on your findings, provide examples and model the impact of any changes you would make

- Illustrate the results: Provide specific examples illustrating the research findings.

- Speed is of the essence: Incorporating data in real-time into strategies and maximising value can be achieved by making it available in real-time

- Work with experts: Design and launch successful projects with the help of a dedicated team of experts

In general,

Market research provides a fact-based basis for estimating sales and profitability for many businesses by providing a foundation for marketing strategy. Doing so makes you more likely to make wise decisions that drive your business forward and poor decisions that may adversely affect it.

Your competitive environment is becoming more challenging. You can assume that your competitors are continuously doing market research to gain an advantage over you. Market research may be the most compelling reason to consider it part of your business expansion plan.

Your business doesn’t have to spend massive financial resources on focus groups and extensive surveys to conduct market research. But, it would help if you did market research in the first place. Now that you understand the need for market research, you're ready to get started.

As long as you end up with a thorough list of your target market’s demographics, needs, and frustrations, you’ll be able to reap the above benefits as you grow your business. Why not get started with your marketing research today?

Need some help?

Carter Consulting can help you manage your research if you lack the skills, capacity or inclination. As an extension of your team, our research services can assist with designing, writing, programming, and reporting the survey based on your needs. Book a meeting with us today!

Comments